Unlike many other metropolitan areas across the country, the Southwest Florida housing market is relatively full of for-sale inventory.

“I think one of the main trends we’re seeing is that our total inventory is up 60% year over year compared to 2023,” said PJ Smith, president of Naples Regional Council of Realtors and broker owner of Naples Golf to Gulf Real Estate. “We’re seeing a healthy increase in inventory, which we really needed.”

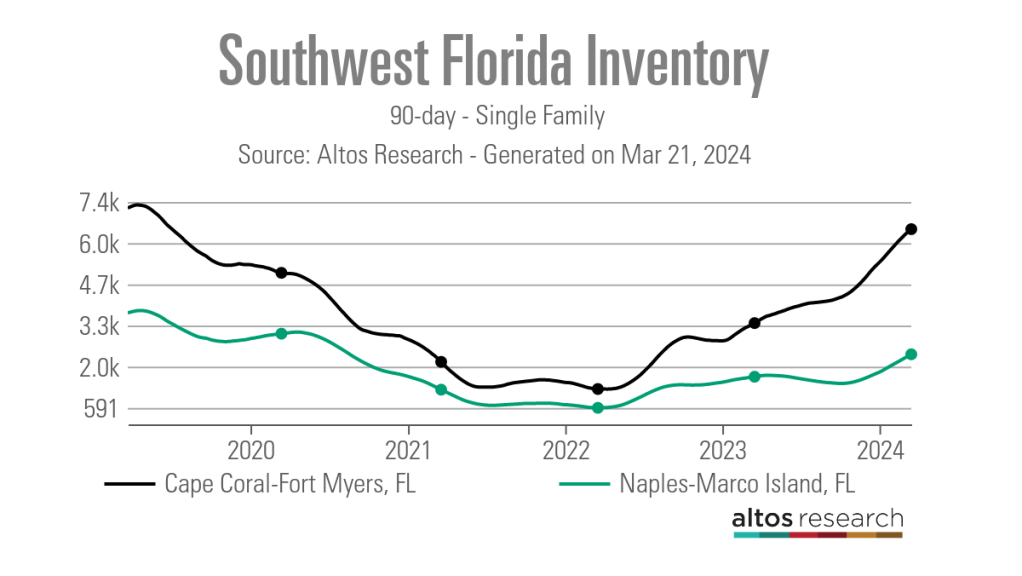

According to data from Altos Research as of March 15, the Naples-Marco Island metro 90-day average number of active listings for a single family was 2,362, up from 1,605 a year earlier, but down from the 3,760 listings recorded at the end of March 2019 before COVID-19 a pandemic.

In the nearby Cape Coral-Fort Myers metro area, active single-family inventory over the previous 90 days averaged 6,500 listings as of March 15, above its March 2020 level of 5,044 listings and nearing its March 2019 level of 7,243 listings.

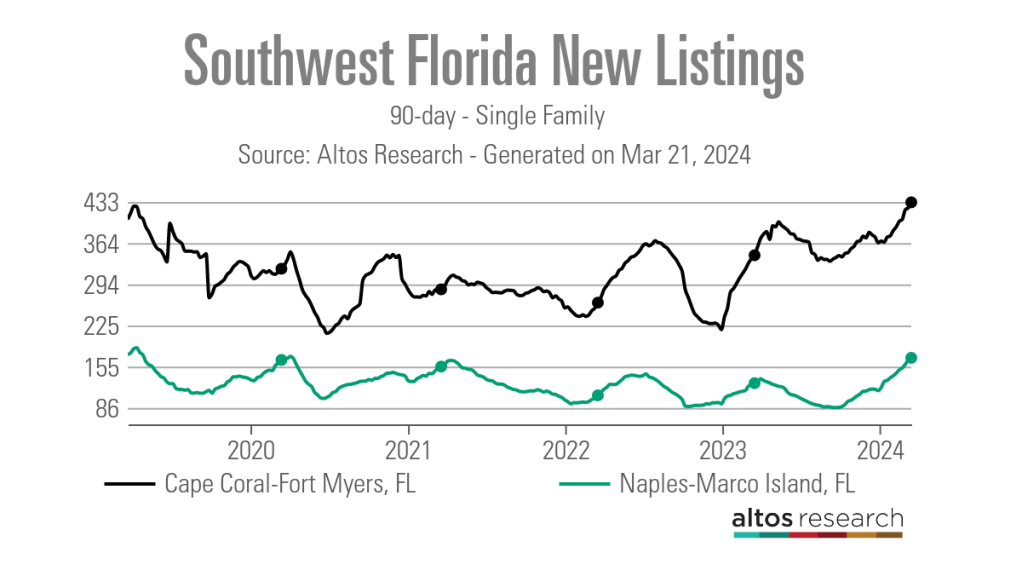

Smith attributes the increase in inventory to a boom in new listings. The 90-day average number of new listings as of mid-March 2024 was 170 in Naples-Marco Island and 432 in Cape Coral-Fort Myers). There is also some pent-up desire to sell, which is being released by a more stable interest rate environment and a generally slower market.

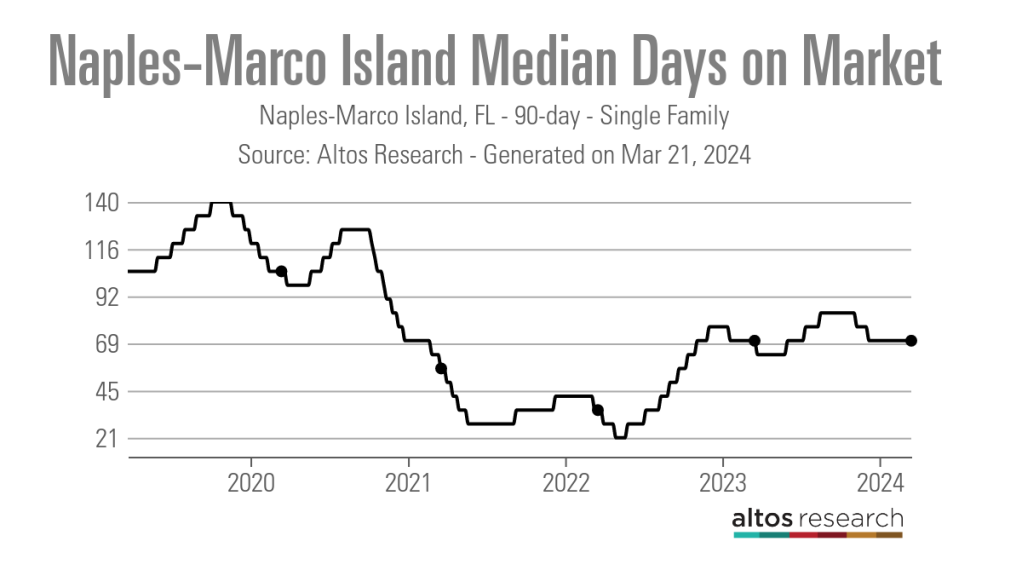

“Last year we were still adjusting from the effects of the pandemic market, but now the trends seem to be returning to our baseline, which is more like our 2019 market,” Smith said. “Days on market are also returning to what is more normal for our market as well.”

Data from Altos Research shows that the 90-day average number of days on the market in the Naples-Marco Island metro area was 70 days as of mid-March, up from a record low of 21 days in mid-May 2022.

While some properties sit on the market longer, Smith noted that those in good condition, at a good price and in a desirable location still sell quickly.

“I just sold a property after two days on the market,” Smith said. “We are still seeing properties come up quickly and some with multiple offers.”

Local real estate professionals attribute the slower market to a variety of factors, including higher home prices that have held steady despite the slowdown, higher interest rates and rising costs for homeowners and flood insurance.

“Florida, like many places, is seeing the insurance part of the component affect people’s payments in a way that makes it difficult for them to navigate the market,” said Cindy Hayden, a Seminole-based agent for Future housing agent.

According to an analysis of S&P Globalbetween 2018 and 2023, Florida homeowners insurance rates jumped 43.2%. From 2022 to 2023 alone, rates have risen by 15%. And data from Insurance Information Institute shows Florida homeowners pay an average of nearly $6,000 a year for insurance, nearly three times what they paid in 2019. By comparison, the average U.S. homeowner’s insurance policy was roughly $1,700 in 2023

Compounding rising insurance costs is the fact that many insurers and reinsurers have decided to leave the state. Those companies cited the recent increase in the number and strength of hurricanes and other weather-related disasters affecting the Sunshine State.

“Florida has seen significantly more hurricanes, so the continued years of bad experience, which means losses for insurance carriers, they have no choice but to increase those premiums,” said Sean Kent, senior vice president of insurance at FirstServiceFinancial.

“Additionally, there are only a few carriers willing to participate and insure some of these units, so access to coverage is greatly reduced.”

These rising costs understandably affect the ability or willingness of some buyers to purchase specific properties.

“Insurance is an expense that’s expected — but nothing as significant as we’re seeing today,” said Tampa-based Cheryl Hawke eXp Realty agent. “We’re seeing contracts fail during the due diligence period because of sticker shock on insurance costs, so that’s definitely an issue.”

Because of this, real estate professionals are bringing insurance partners into their deals much earlier than before.

“It’s definitely a serious concern and issue,” Smith said. “What we recommend is before you go into contract with a property, you consult and get a quote so you know what your potential insurance costs will be.”

In addition to dealing with rising insurance costs with buyers, agents said they’ve also had to field questions from past clients about rising premiums, who often need help finding ways to lower their costs.

“We’ve had customers come in and ask why they’re seeing a 62% jump in their insurance, but we’ve been able to help them, whether it’s raising their deductible or connecting with some of our other insurance contacts,” Hawke said. .

Despite rising insurance costs making homeownership in these markets more expensive, local real estate professionals don’t think that’s behind the recent surge in new listings.

“We’ve seen a lot of people move out of state to more affordable markets,” Hook said, “but it’s all relative because we also see a lot of people move because our market is more affordable than New York or California.

However, if premiums continue to rise, agents believe it could become a bigger problem, especially for the area’s large population of retirees.

“When we look at people who are getting closer to retirement or are on fixed incomes, it’s becoming more of a concern,” Hayden said. “People are really pressed by affordability.”

But while rising insurance costs are certainly a challenge for homeowners and buyers in Southwest Florida, Hayden said the slower housing market is good news for many buyers.

“I have negotiated some of the most incredible deals for my buyers who are currently on the market that I have seen since the housing market crash of 2008,” Hayden said. “I had a buyer last month and the property was listed for $475,000, but with the necessary repairs it was worth $410,000 and we were able to negotiate an offer of $410,000.

“Typically, I would tell buyers that if they have 10 percent off list price, they’re operating in different realities than the seller.”

Hayden said she has recently had offers accepted with sales contingency, closing cost coverage and various other seller discounts.

Although things have slowed since the height of the crazy post-pandemic market, local agents are optimistic about where the market is headed this spring and summer.

“It’s very busy. Literally on January 1st, the faucet turned on,” said Diane Peters, co-founder of The Pithers Group, based in Tampa and Coldwell Banker Realty– brokerage firm. “There are a lot of buyers in the market and we really focus on showing value to sellers to spread those listings so there are homes for buyers to buy. It’s going to be a really strong spring and summer.”